Doom for ex-China Permanent Magnets

16 11 20 07:52

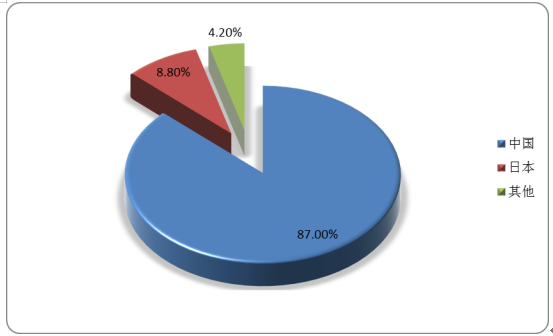

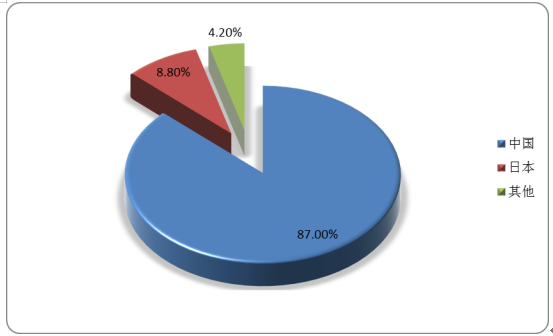

Look at this global market share of NdFeB permanent magnets, made from ~25% neodymium, ~5% praseodymium, ~1% dysprosium, ~1% terbium and the rest is iron (magnetite):

Source: 2020 China Rare Earth NdFeB Material Market Research Report-Industry Status and Future Business Opportunities Forecast Blue is China, red is Japan, green is others.

With Japan’s Hitachi Metals for sale, quite possibly to a dominant magnet company in China who happens to have a joint venture with a US-owned magnet maker in Germany, China’s world market share in NdFeB magnets may rise above 90%.

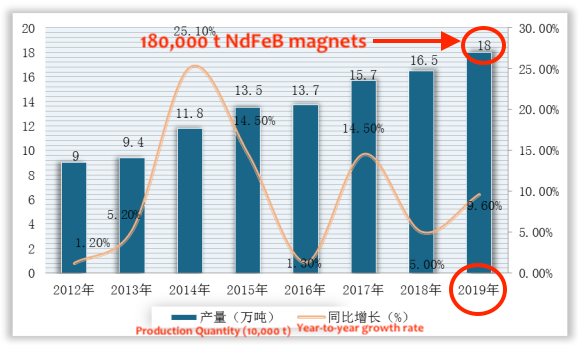

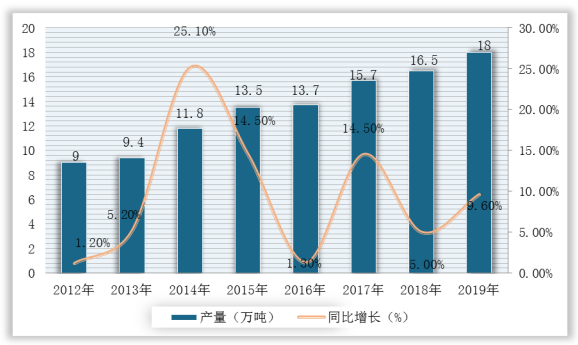

China’s 2019 output was 180,000 t of NdFeB magnets. Here the growth history for China’s output of NdFeB magnets (in ten thousands of metric tons):

Source: 2020 China Rare Earth NdFeB Material Market Research Report-Industry Status and Future Business Opportunities Forecast

Yes, it doubled from 2012 to 2019.

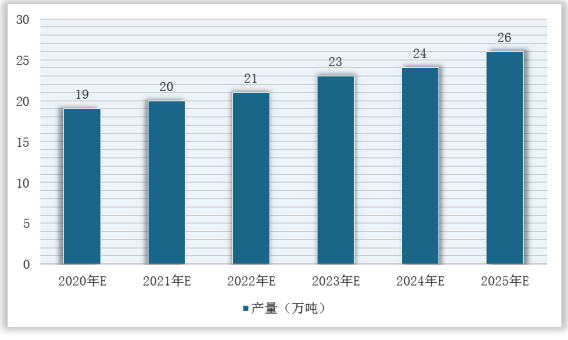

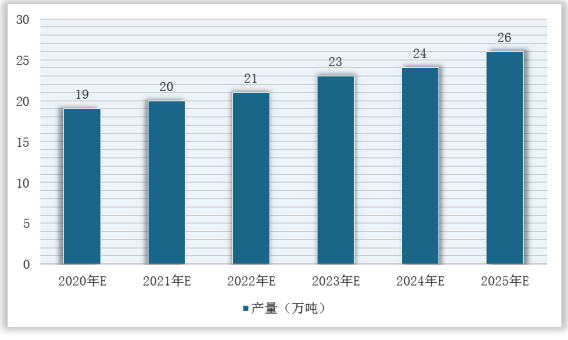

And now here the growth forecast for NdFeB magnet production in China until 2025 (in ten thousands of metric tons):

Source: 2020 China Rare Earth NdFeB Material Market Research Report-Industry Status and Future Business Opportunities Forecast

2025 is an increase of more than 35% over 2020.

Only about 20% of that is export to more than a hundred countries. Largest export destinations are Germany (18% of exports), Japan and USA (each 12% of exports). A large part of the exports to Germany is probably production of a German-Chinese joint venture in Beijing.

Now one could conclude, that the West not only depends on China’s rare earths, but also on China’s permanent magnets.

We think the West is about to move past that point: The western import dependence is on components and products manufactured from rare earths and permanent magnets, moving a step higher on the value chain that current concepts suggest.

One of the current battles is on for the dominance in traction motors for electric vehicles, containing NdFeB magnets (we reported).

What? Why?!In the first half 2020 China exported 142 t neodymium oxide, valued at US$ 6.7 mio, 24 t less than in the second half 2019.

Source: 2020 China Rare Earth NdFeB Material Market Research Report-Industry Status and Future Business Opportunities Forecast Blue is China, red is Japan, green is others.

With Japan’s Hitachi Metals for sale, quite possibly to a dominant magnet company in China who happens to have a joint venture with a US-owned magnet maker in Germany, China’s world market share in NdFeB magnets may rise above 90%.

China’s 2019 output was 180,000 t of NdFeB magnets. Here the growth history for China’s output of NdFeB magnets (in ten thousands of metric tons):

Source: 2020 China Rare Earth NdFeB Material Market Research Report-Industry Status and Future Business Opportunities Forecast

Yes, it doubled from 2012 to 2019.

And now here the growth forecast for NdFeB magnet production in China until 2025 (in ten thousands of metric tons):

Source: 2020 China Rare Earth NdFeB Material Market Research Report-Industry Status and Future Business Opportunities Forecast

2025 is an increase of more than 35% over 2020.

Only about 20% of that is export to more than a hundred countries. Largest export destinations are Germany (18% of exports), Japan and USA (each 12% of exports). A large part of the exports to Germany is probably production of a German-Chinese joint venture in Beijing.

Now one could conclude, that the West not only depends on China’s rare earths, but also on China’s permanent magnets.

We think the West is about to move past that point: The western import dependence is on components and products manufactured from rare earths and permanent magnets, moving a step higher on the value chain that current concepts suggest.

One of the current battles is on for the dominance in traction motors for electric vehicles, containing NdFeB magnets (we reported).