Quo vadis: China Steel Exports Q1-Q3 2017 by Destination

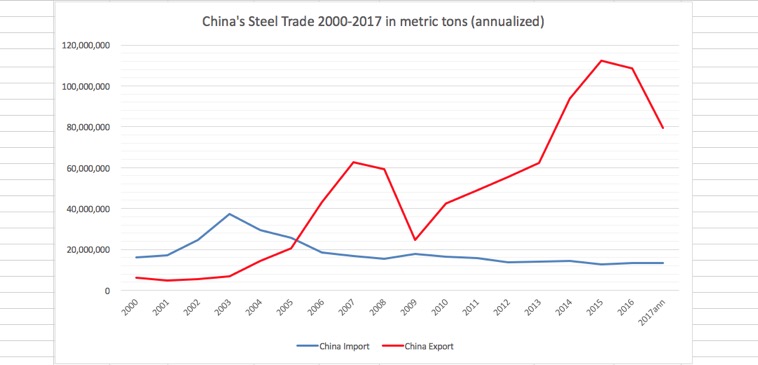

Chinese steel exports during the first three quarters of 2017 were 59.613 million tons, down 25.5 million tons or 30% year on year.

The fundamental reasons for this decline were discussed in our previous article, plus Allan Liu's (CLIK) valuable contribution, that China has started enforcing the probably WTO non-compliant export duty on steel billets, which previously were exported as square bars in circumvention of the export duty. Consequently, the China export of bars and rods dropped by 62% yoy to 13 million tons during the first 3 quarters of 2017.

As of January 1, 2004 China had reduced the VAT refund upon export for steel billets from 13% to zero. As this did not stop China steel billet exports from rising, China introduced an export duty of 10% on November 1, 2006. The current export duty for steel billets is 15%. The link to the relevant export tariffs for 2017 is here.

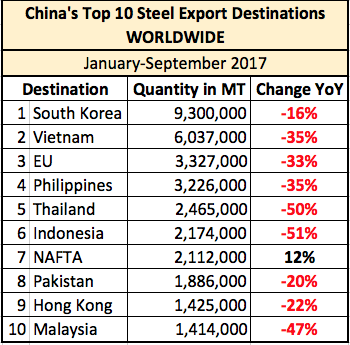

The top 10 destinations account for 56% of China's total steel exports Q1-Q3 2017

Exports to NAFTA increased because shipments to Canada were 762,000 tons, up 38% year on year and there were insignificant increases of steel shipments to Mexico and USA, stable on a low level.

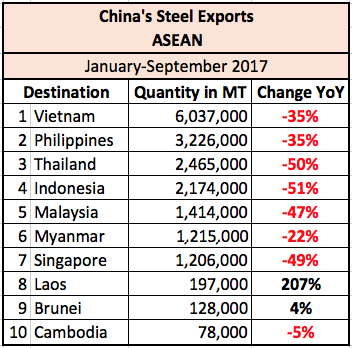

China's steel shipments to ASEAN are 30% of China's steel exports Q1-Q3 2017

Exports to Singapore declined, because Singapore serves as a distribution hub for Chinese steel to regional countries, including those who took trade action against Chinese steel.

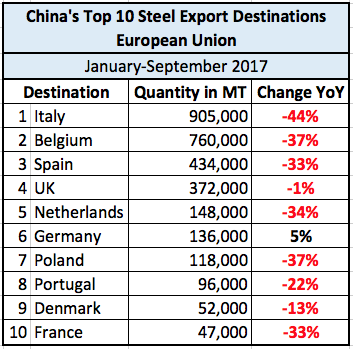

At 3.3 million tons, China steel exports to the EU are a mere 5.6% of the total

Antwerp is a major port of entry for steel, destined for other EU members incl. BENELUX, Germany and France, so this top 10 list is not necessarily representative.

10% of Chinese steel exports were headed for Middle East

6% of Chinese steel exports went to South America

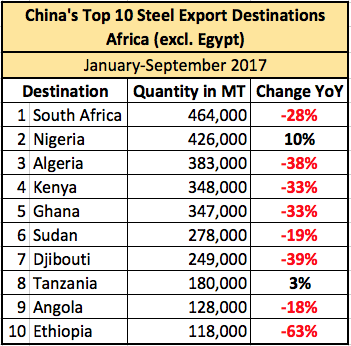

At 9.3 million tons, China ships 3 times more steel to tiny South Korea than to the entire African continent

Exports to the CIS increased 33% yoy to 1.384 million tons, driven by Russia 747,000 tons (+35%), Uzbekistan 317,000 tons (+63%) and Kazakhstan 236,000 tons (+28%).

Those who seek deeper analysis, this report of the U.S. International Trade Commission may be valuable.

There is still a lot to be done in terms of China's supply-side reform and wind-down of trade manipulation using export tariffs and equally distorting, uneven VAT refund upon export rates, until destination countries can abandon trade action against Chinese steel and allow free trade among equals to blossom.